Latest

General Interest Charge and Shortfall Interest Charge To Become Non-refundable

On 26 March 2025, Parliament passed a significant amendment affecting tax deductibility: from 1 July 2025, general interest charge (GIC) and shortfall interest charge (SIC) will no longer be tax-deductible for businesses or individuals. This change is a significant...

The Financial Year Obligations for Businesses

If you’re managing your own business, you’re probably familiar with the stress and organisation that goes into it. However, handling taxation rules and regulations can add another layer of complexity to your already stressful workload. If you accidentally miss a...

Work-From-Home Fixed Rate Method Increase For 2024-2025 Year

If you regularly work from home, a small but potentially welcome update from the Australian Taxation Office (ATO) could impact your next tax return. In a retrospective update to legislation, the fixed rate for claiming work-from-home expenses has been proposed to...

Depreciating Assets This Tax Time – How Does It Work?

When you purchase equipment or other long-term assets for your business, you may not be able to claim the full cost upfront. However, you can generally claim a deduction over time for the decline in value of those assets - a process known as depreciation. A...

Make Sure You’re Getting The Right Advice This Tax Time

With the end of the financial year fast approaching, many people start looking for quick answers about deductions, income reporting, and how to get the best result on their tax return. And while it might be tempting to ask Google - or even ChatGPT - for guidance,...

Hidden Costs & Taxes In Your First Property Purchase

Buying your first home is an exciting milestone, but many first-time buyers underestimate the additional costs beyond the purchase price. Understanding these hidden expenses can help you budget effectively and avoid financial strain. Stamp Duty Stamp duty is one of...

Is There Such A Thing As A Tax-Free Lunch?

They say there's no such thing as a free lunch - but what about a tax-free one instead? One of the policies proposed by the Liberal Party ahead of this year’s election surrounds the concept of entertainment, particularly concerning tax. Under the proposed policy,...

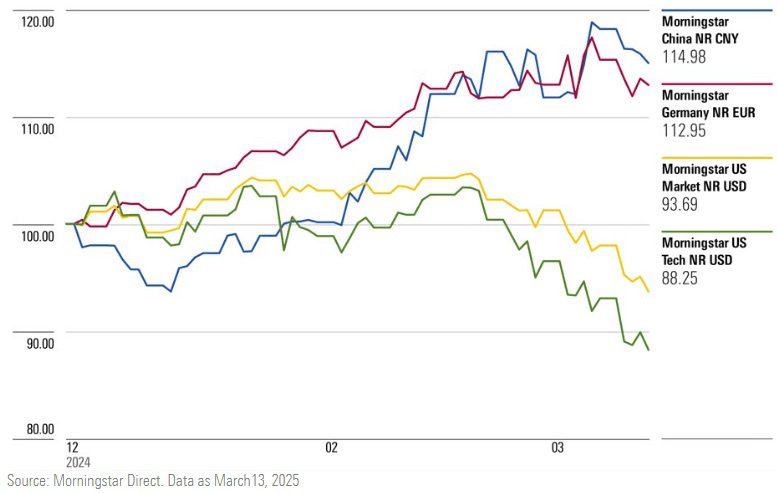

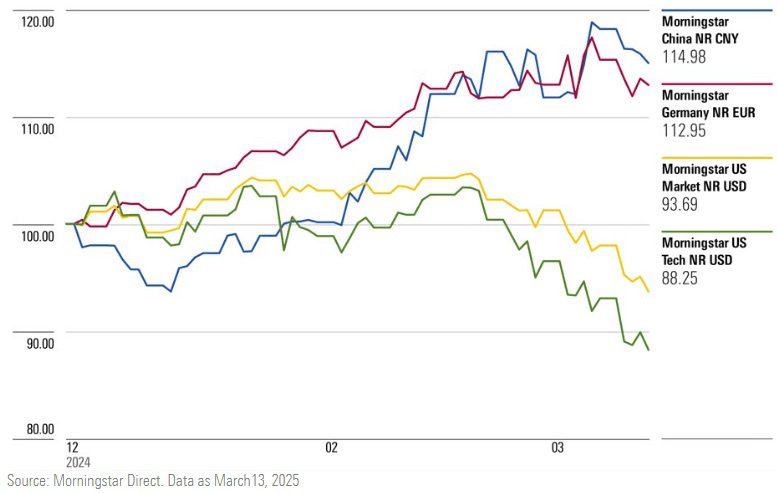

Do you have a Financial Strategy in place to survive the Trump Slump?

Since the beginning of the year, global stock markets have delivered mixed results, almost the inverse of recent years. Initially, people were optimistic about the US economy with markets priced for US exceptionalism to continue. Economic policies under the Trump...

2025–26 Federal Budget – What It Means for You

The following are key points from the Australian Federal Budget 2025–26 (handed down on 25 March 2025) and explain how they might affect you or your business. If you would like further details on any of these points please contact our office. Headline Budget Measures...

Why your small business needs to switch to online accounting

Running a business is hard enough without having to wrestle with out-of-date accounting records. That’s where cloud accounting comes in—a modern solution that can make your life a whole lot easier. This article explores why small businesses should embrace cloud...

General Interest Charge and Shortfall Interest Charge To Become Non-refundable

On 26 March 2025, Parliament passed a significant amendment affecting tax deductibility: from 1 July 2025, general interest charge (GIC) and shortfall interest charge (SIC) will no longer be tax-deductible for businesses or individuals. This change is a significant...

The Financial Year Obligations for Businesses

If you’re managing your own business, you’re probably familiar with the stress and organisation that goes into it. However, handling taxation rules and regulations can add another layer of complexity to your already stressful workload. If you accidentally miss a...

Work-From-Home Fixed Rate Method Increase For 2024-2025 Year

If you regularly work from home, a small but potentially welcome update from the Australian Taxation Office (ATO) could impact your next tax return. In a retrospective update to legislation, the fixed rate for claiming work-from-home expenses has been proposed to...

Depreciating Assets This Tax Time – How Does It Work?

When you purchase equipment or other long-term assets for your business, you may not be able to claim the full cost upfront. However, you can generally claim a deduction over time for the decline in value of those assets - a process known as depreciation. A...

Make Sure You’re Getting The Right Advice This Tax Time

With the end of the financial year fast approaching, many people start looking for quick answers about deductions, income reporting, and how to get the best result on their tax return. And while it might be tempting to ask Google - or even ChatGPT - for guidance,...

Is There Such A Thing As A Tax-Free Lunch?

They say there's no such thing as a free lunch - but what about a tax-free one instead? One of the policies proposed by the Liberal Party ahead of this year’s election surrounds the concept of entertainment, particularly concerning tax. Under the proposed policy,...

Do you have a Financial Strategy in place to survive the Trump Slump?

Since the beginning of the year, global stock markets have delivered mixed results, almost the inverse of recent years. Initially, people were optimistic about the US economy with markets priced for US exceptionalism to continue. Economic policies under the Trump...

2025–26 Federal Budget – What It Means for You

The following are key points from the Australian Federal Budget 2025–26 (handed down on 25 March 2025) and explain how they might affect you or your business. If you would like further details on any of these points please contact our office. Headline Budget Measures...

Why your small business needs to switch to online accounting

Running a business is hard enough without having to wrestle with out-of-date accounting records. That’s where cloud accounting comes in—a modern solution that can make your life a whole lot easier. This article explores why small businesses should embrace cloud...

Understanding Annual Leave and Long Service Leave

For small business owners, figuring out the difference between annual leave and long service leave can feel like trying to crack a secret code. Rules, jargon… seriously, who made this stuff so complicated? Whether you’re trying to keep your business compliant or...

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.